"Dishonest scales are an abomination to the Lord,

But a just weight is His delight."

Proverbs 11:1

When all else fails, read the report:

Rail Bond Vote Would Bring Historic Tax IncreaseAnd that's just one of the five taxing entities in town!!!

By Bill Oakey – July 30, 2014

If anyone thinks the property tax impact of an annual City Council budget battle is something to worry about, please consider this. For the last two years, the budget discussions have centered around changing the City’s tax rate by a tiny fraction of one penny. That’s because our tax appraisals have skyrocketed, meaning that even a zero change in the tax rate would yield a considerable tax increase.

Well, make sure you are sitting down when you read this. If voters approve the $1 billion urban rail and road bond package in November, they can say hello to a 6 cent increase in the property tax rate over the next five years. The sobering details are contained in a City document called “General Obligation Bond Capacity Analysis.” You can read it here.

What Would Happen to Our Bond Debt If the Rail Bonds Pass?

That’s an easy question to answer. It would flat out double! Our current general obligation debt, made up of previous bond votes for roads, parks, libraries, open space, and housing stands at about $1 billion. So, in one fell swoop we would double our debt by voting for the rail and road package. And the worse part is that it would do essentially nothing to relieve traffic congestion for most existing residents.

....

What the City Report Says About Taxes, the Debt and Our Bond Rating

Here is a snapshot of some of the report’s most significant facts and conclusions:

1. Our current general obligation debt is about $1 billion.

2. We still have an additional $425 million in 2006-2013 bonds left to issue.

3. The City estimates that another $425 million will be needed in a separate bond election in 2018, on top of the $1 billion in rail and road bonds to be voted on this November.

4. In order to preserve our AAA bond rating, we would need to raise property taxes by 6 cents between 2015 and 2020 if all of the bonds pass.

5. Not only would the property tax rate increase by 6 cents, but the City estimates that property tax appraisals will jump by over 25%! Their example shows a $200,000 home being assessed at $255,000 by 2020. So, the tax impact would multiply exponentially.

Read the whole thing here.

-----

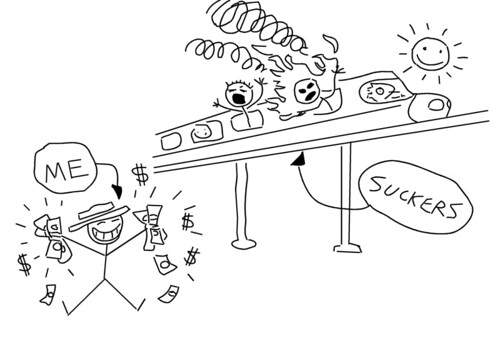

Update: Here's a chart to explain the above....

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.